When it comes to generating revenue, some businesses have a pretty straightforward life.

They invest a ton of resources into acquiring new customers, and once a sale is made, that's it: the money is in their pocket, and they can focus on acquiring new customers.

You, however, have a harder time. Your SaaS business operates on recurring revenue, and any given month, you face a fresh new battle to earn the continued trust of your customers.

Your job is never done, and your monthly revenue relies on ongoing customer support, continued product development, upselling and cross-selling, just as much as it relies on new sales.

In other words, each and every month, you have the opportunity to gain new customers - but you also have the potential to lose existing ones.

When Customers Churn

The rate at which you lose customers is known as customer churn, and it affects the health of your business in a very signficant way; impacting MRR, CLTV and a whole host of other crucial metrics.

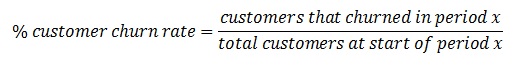

The simplest way to calculate customer churn is to take a monthly measurement across your entire customer base. You simply add up the number of customers that churned that month, and divide it by the total number of customers at the start of the month:

However, this type of measurement blends together the churn rates of new customers and existing customers.

However, this type of measurement blends together the churn rates of new customers and existing customers.

Shiny new customers that signed-up that month are lumped together with long-standing customers, despite the fact that:

- Churn rates are likely to vary between the different groups.

- New customers and existing customers will have very different reasons for churning.

Invisible Problems

This blending together of churn rates creates invisible problems for your business.

For example, you may have a fantastic onboarding process, but lousy customer support.

Happy new customers will contribute to low churn in the first few months, but mounting frustrations further down the line will lead to high churn later in life.

Unfortunately, if we used a simple average measurement of churn each month, the low churn rates of new customers would offset the high churn rates of existing customers.

We wouldn't gain any insight into the success of our onboarding process, or the failure of our customer support. Without that information, we couldn't fix the problem.

The Solution: Cohort Analysis

That's where cohort analysis comes in.

Instead of grouping all of our customers together each month, we can seperate them out into more meaningful groups (known as cohorts).

Each customer within a cohort will share a similar experience or characteristic.

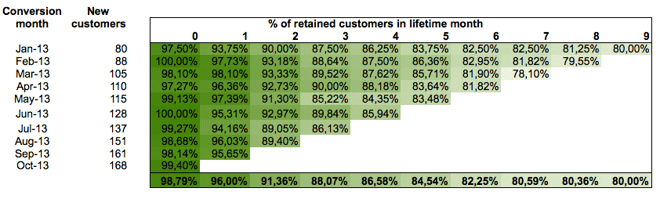

In the example below, customers are grouped horizontally according to the month they became paying customers. Vertically, they're seperated out according to the length of time they've been customers. And along the bottom you've got the average percentage of retained customers for that lifetime month, which will help you identify trends in your data.

These cohorts add a whole lot of insight into the reasons customers churn.

It might be that we notice a statisical outlier, and discover that customers that signed-up in January were more likely to churn than those from other months.

Digging further, we might be able to attribute it to a surge in outbound advertising, and an influx of less-than-best-fit customers.

Returning to our earlier example, we might see that churn rates are exceptionally low during the first 2 months, but start to increase sharply from 3 months onwards.

A few customer surveys later, and we've heard praise for our onboarding tutorial and disappointment at our ongoing support.

The Story Behind the Data

Cohorts add context to your data, and help reveal the story behind the statistics.

They introduce qualitative elements (the experiences and characteristics of your customers) to the quantitative, and turn complex information into actionable insights.

With churn playing such an important role in determining the health of your business, those insights are invaluable.