Growing a SaaS startup is an all-consuming grind.

But there comes a point when the late nights and hard decisions become a little bit easier.

You're still devoting every waking thought to product development, sales process improvements and marketing - but now, you have a little bit more confidence in your hard graft.

Because what you're doing is working.

People are using, enjoying, and paying for your software - and you've just found Product/Market Fit.

What is Product/Market Fit?

Today, we're taking a software-specific look at one of the most essential KPIs your SaaS solution needs to understand - and discovering four reasons your success depends on the near-mythical concept known as Product/Market Fit.

There are dozens of competing interpretations around, but for a good starting point, we can't beat the original definition:

Marc Andreesen, Andreesen Horowitz

Product/Market Fit means being in a good market with a product that can satisfy that market.

In other words, Product/Market Fit (PMF) is a way of assessing:

- The ability of a market to sustain your business.

- The ability of your product to meet the needs of that market.

In simple terms, a good market is an expanding market, capable of supporting your business now and into the future; a bad market is contracting.

We're also talking about the specific market for your solution (say, the market for CRM solutions) - not the sector/industry that market resides in (the software or technology sectors).

Why Does Product/Market Fit Matter?

1) Product/Market Fit Changes Your Priorities

Prior to PMF, your priority needs to be product development.

You'll be operating on a lot of assumptions, and as you learn more about the market for your SaaS solution, you'll need the flexibility to reshape (and even pivot) your product appropriately.

Investments into sales, marketing and customer success should be used to test those assumptions, and experiment - not to actively scale-up your business.

After achieving PMF, your priorities will change.

You'll have solid indicators that the market can support your business, and that your product effectively solves an important problem.

You can begin to think about securing growth capital, and ramping up your growth investments:

- Hiring a VP Sales or a Chief Revenue Officer.

- Building out your sales team.

- Improving your onboarding process.

- Scaling up your marketing campaigns.

2) PMF Means It's Safe to Scale

If you decide to scale-up a SaaS company without proven Product/Market Fit, you're taking a huge risk. There's no guarantee that a market for your product exists. Even if it does, it might not be able to sustain your business.

![]() Without PMF, major investments into marketing, sales and customer success are premature.

Without PMF, major investments into marketing, sales and customer success are premature.

No amount of sales & marketing savvy can sell a product that nobody needs or wants, and when problems appear, it'll be impossible to determine whether your business is stagnating because of inefficient growth strategies, or because you've developed a product that solves a nonexistent problem.

3) Poor PMF Calculations Kill SaaS Companies

Without a good understanding of Product/Market Fit, many SaaS businesses prematurely shift capital away from engineering and development, and into growth.

![]() Even if they're able to secure customers, those customers will be paying for a solution that doesn't meet their needs, and in many cases, having to battle with systems that don't scale properly.

Even if they're able to secure customers, those customers will be paying for a solution that doesn't meet their needs, and in many cases, having to battle with systems that don't scale properly.

Instead of being a boon to growth and profitability, the decision to scale can cripple a SaaS business. This can serve to damage its reputation - even burdening it with an influx of customer complaints and generating tons of refund requests.

4) Markets Change, and You Need to Change With Them

Remember the Innovator's Dilemma?

A new solution achieves PMF, and manages to capture the lion's share of the market.

They become the dominant player, and stay that way, until new technology appears and supersedes their solution.

By failing to stay ahead of changing technology, the incumbent company loses marketshare to a smaller, disruptive business, who in turn, go on to dominate the market.

Rinse and repeat.

In this narrative, the market for a product evolved over time, and the definition of Product/Market Fit changed with it. As a result of developing technology, a solution that fits the market in the here-and-now might not fit the same market in the future.

PMF is like an ongoing health check for your business, allowing you to periodically test the key assumptions that underpin your business:

- Does the problem we solve still exist?

- Is the problem important enough?

- Is the market for our product still a 'good' market?

Understanding PMF helps us allocate resources in the short- and medium-term, but it also provides visibility into the future.

Instead of resting on our laurels, we can use Product/Market Fit surveys to provide the impetus we need to continually develop and grow - no matter how the market develops.

Myths of Product/Market Fit

For burgeoning SaaS businesses, Product/Market Fit is the holy grail: a sure-fire sign that an influx of customers, revenue and profit is just around the corner.

Well, not quite.

There's more to Product/Market Fit than meets the eye, and to set your software solution on the path to success, we need to get to grips with this essential (and enigmatic) metric.

Today, I'm taking a look at 4 of the biggest and baddest myths surrounding Product/Market Fit.

Myth #1: There's a Magic Metric for Determining product/Market Fit

We can't calculate Product/Market Fit (PMF) in the same way we can Customer Churn or CLTV.

![]() Your revenue generation plays a part in determining PMF, and so does activation, customer churn, customer success, and a whole host of other crucial SaaS metrics. Even more importantly, these metrics only make sense in the context of your wider business.

Your revenue generation plays a part in determining PMF, and so does activation, customer churn, customer success, and a whole host of other crucial SaaS metrics. Even more importantly, these metrics only make sense in the context of your wider business.

For example, it doesn't matter if 40% of your customers would be devastated by the loss of your service (one of the oft-quoted hallmarks of PMF), if your entire customer-base is no more than 10 customers.

The same applies even if you have 100 customers, and they're generating £50,000 in revenue - you still don't have a large enough sample size to represent an entire market and draw a significant conclusion.

Myth #2: When You Hit Product/Market Fit, You'll Know It

It's essential to look for indicators of Product/Market Fit, but you'll rarely (if ever) negate the uncertainty associated with your calculations.

As Marc Andreesen said, Product/Market Fit isn't a "discrete, big bang event": few SaaS startups will achieve the insane levels of growth required for a definite Product/Market Fit realisation.

Instead, it's more common to see businesses jump closer to PMF in fits and starts: finding traction in small sub-markets, and heading closer to their "good market" bit by bit.

For a real-world example of this in action, check out Marc's commentary on Joel Spolsky's Stack Overflow:

He has achieved product market fit in the collaboratively edited Q&A market for audiences such as software engineers and mathematicians.

Is this the primary product market fit? Neither of those markets seem that big.

Will he need significant new features to find the big product market fit?

Probably. Should he invest or stay lean? Good question, and there’s no formulaic answer.

Marc Andreesen, Andreesen Horowitz

Myth #3: Product/Market Fit is a One-Off Event

It's important to remember that markets change over time. Technology improves, problems change and the needs of buyers evolve.

![]() Even if you've achieved PMF in the current market for your product, there's no guarantee you'll fit the same market a year's time, or two, or ten.

Even if you've achieved PMF in the current market for your product, there's no guarantee you'll fit the same market a year's time, or two, or ten.

Instead of being a one-off, high-five moment, PMF offers an instantaneous snapshot into the performance and fit of your product at a single moment in time.

To continue growing into the future, your product needs to change alongside your market - and that means looking for PMF a whole bunch of times.

Myth #4: Product/Market Fit Means You've Won

Achieving Product/Market Fit doesn't make a product invincible.

A "good market" means a market ripe with opportunity, and in the vast majority of cases, that means competition. Even if your solution achieves PMF, you can still be out-competed by other good-fit businesses.

![]() When you hit Product/Market Fit, it's time to hit the accelerator. Instead of resting on your laurels, you need to ramp-up your sales, marketing and customer success, and beat all of the other good-fit businesses to the punch.

When you hit Product/Market Fit, it's time to hit the accelerator. Instead of resting on your laurels, you need to ramp-up your sales, marketing and customer success, and beat all of the other good-fit businesses to the punch.

Even if you manage to capture the lion's share of the market, changes in technology can quickly render your solution obsolete.

It's the classic Innovator's Dilemma: your once disruptive solution gets unseated by a newer, more disruptive upstart.

The only way to survive is to hit Product/Market Fit, and accelerate; to watch for changes in the market, hit Product/Market Fit again, and accelerate; over and over again.

The Sean Ellis Test

Trying to scale too early can cripple your startup; too late, and a competitor will beat you to the punch.

So, to help you determine when it's time to hit the accelerator and scale-up your SaaS business, I'm taking a look at one of the most popular methods for calculating Product/Market Fit: the Sean Ellis test.

What is the Sean Ellis Test?

With so many competing definitions, Product/Market Fit can be difficult to get to grips with; it's both essential to understand and extremely difficult to do so.

It's for that reason Sean Ellis (DropBox, Lookout, Eventbrite, LogMeIn...) set out to create a straightforward test to help founders identify the crucial moment when their solution finds Product/Market Fit.

Sean's simple PMF survey takes a step back from complex metrics, and instead focuses on the most revealing data source at any SaaS company's disposal: their users.

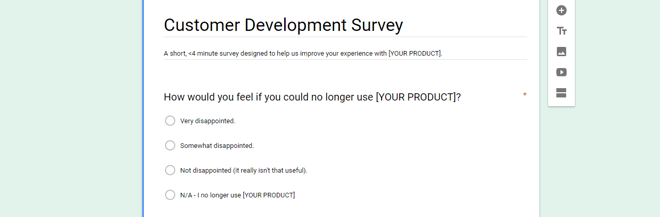

How would you feel if you could no longer use [product]?

- Very disappointed

- Somewhat disappointed

- Not disappointed (it isn’t really that useful)

- N/A – I no longer use [product]

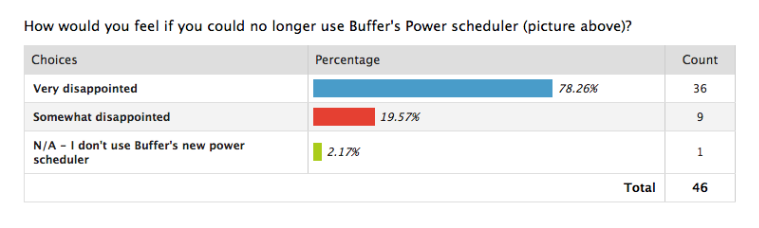

If over 40% of users respond to the survey saying they'd be "Very disappointed" to stop using your product, there's a great chance your solution has found Product/Market Fit. Why?

After comparing nearly 100 startups, Sean found that those that struggled to reach traction always scored under 40% on this particular test. In contrast, those that managed to gain strong traction always scored over 40%.

Applying this to your business, you have a quick and dirty way of gauging Product/Market Fit.

With enough good-fit users (see below) to survey (Buffer determined that 40-50 responses should carry statistical significance), you can make an informed decision to either double-down on product development, or start to scale-up your sales, marketing and customer success.

I generally recommend to survey the following:

Sean Ellis

- People that have experienced the core of your product offering.

- People that have used your product at least twice.

- People that have used your product in the last two weeks.

Pros of the Sean Ellis Product/Market Fit Test

1) IT'S SUPER SIMPLE

The simpler a metric is, the more likely it is that people will actually use it.

Even the best-intentioned of tech startups end-up with a huge dashboard of KPIs that look useful, without having any real understanding of how to actually use the metrics to help their business grow.

The Sean Ellis Product/Market Fit test sidesteps this problem - creating a metric that's easy to calculate, easy to understand, and easy to use.

2) IT'S USER FOCUSED

Despite the perceived complexity of trying to determine Product/Market Fit, at it's heart, it's pretty simple: we're trying to find out if people want our product.

...most startups fail not because they don’t manage to develop and deliver a product to the market; they fail because they develop and deliver a product that no customers want or need.

Steve Blank

Sean's test homes in on the people that engage with your product. Instead of fixating on a ton of quantitative, context-less data, it helps founders touch base with reality, and find out how their users and customers actually feel about their product.

Sometimes we lose track of our customers and instead focus on terms, such as “product/market fit” and if we were in closer touch with our customers we would know whether we have it or not.

Leo Widrich, Buffer

Cons of the Sean Ellis Product/Market Fit Test

1) INTENTION =/= ACTION

This is a classic problem with any type of survey, from the Sean Ellis test to Net Promoter Scores (also used as a PMF indicator): there's almost always a disconnect between what people say they'll do, and what they actually do.

There's no guarantee that survey responses, no matter how well intentioned, will actually foreshadow action. If a business bets their entire growth strategy on a single survey, they're exposing themselves to a whole lot of risk.

While surveys are useful, I would much rather take bets on what people are doing, not what they say they would do or are doing.

This is why I think about these surveys more of as a leading indicator of product market fit vs proof of product market fit.

Brian Balfour, Reforge

2) IT INDICATES PMF, BUT DOESN'T GUARANTEE

Sean's testing revealed that a score of 40% or higher correlates with Product/Market Fit - but as my Stats professor used to hammer into us every lecture, correlation does not equal causation.

A positive score on this test strongly indicates PMF, but it doesn't guarantee it. The market for your product is going to be nuanced and complicated, and it's entirely possible for a product to excel at this test, only to crash and burn during the attempt to scale.

Knowledge is Power

Any Product/Market Fit test needs to be viewed as an indicator of PMF, and not proof.

It's impossible for any test to generate a guaranteed Yes/No, because the question we're trying to ask is so complicated, and the variables we're trying to measure change so frequently.

As a result, the more information you have, the more you can de-risk the decision to scale.

Though imperfect, the Sean Ellis Product/Market Fit test plays a huge part in calculating PMF, allowing you to take the pulse of the people that will make or break your business: your users.

The David Cummings Test

Tests for determining Product/Market Fit come in all shapes and sizes, from the super simple to the over-complicated.

Today, we're looking at the pros and cons of one of the most popular: the approach used by Pardot founder, David Cummings.

What is the David Cummings Test?

David's approach is relatively simple: if you're able to satisfy these 5 criteria, you have a good indication that you've reached Product/Market Fit (PMF).

1. 10+ customers have signed-up in a short period of time (typically 3 - 9 months). Crucially, these need to be legitimate customers, and not 'friendlies' - people with an existing relationship to you, or those trying your product as a favour.

2. You have at least 5 customers actively using the product with little/no product customisation. This means that your product is useful in its current state, and doesn't require extensive modification to make it useful to each new customer.

3. At least 5 customers have used the product for over a month without finding a bug.

4. At least 5 customers use the product in a similar way, and achieve similar results. It's common to see early-stage customers using your product in all manner of weird, wonderful and unintended ways - but it's consistent usage patterns that suggest your product is ready to scale.

5. At least 5 customers exhibited a similar acquisition and onboarding process. In addition to using your product in a consistent way, your customers need to sign-up and start using it in a repeatable fashion using it in a repeatable fashion. It's these repeatable processes that lay the building blocks for scale.

Successfully achieving each of these 5 goals may seem like a far-reach for some early-stage Startups, and that's intentional.

Achieving Product/Market Fit is an ongoing process, and not a discrete, big bang event. David's goals are designed as benchmarks for monitoring progress towards Product/Market Fit. Instead of creating a measurement with a binary output, they provide insights into how Product/Market Fit can be continually developed and improved.

There’s an ongoing maturation process that takes time, even with extended resources. As a founder deep within the process of developing product / market fit, it’s useful to refer back to these five ways to assess progress.

David Cummings

Pros of the David Cummings Product/Market Fit Test

1) IT FOCUSES ON QUALITY OVER QUANTITY

The main reason to determine PMF is to calculate when it's safe to scale your business. To assess this, your total number of customers isn't as important as the quality of those customers.

For example, you could have a hundred customers actively using your product; but if they're each using it in a different way, to achieve different goals, it'll be almost impossible to scale that success.

David's goals focus explicitly on the quality of customer engagement, more so than the volume of customers. In doing so, it makes sure that the essential building blocks of your business - the product's key functionality, its reliability, and its ability to solve a valuable problem - are ready to scale.

...signing 10 customers that fit your ideal customer profile is more important than signing a large number of random customers in the near-term...

— Customers will always ask for product enhancements, so it’s key that requests align with the entrepreneur’s vision of the future

— Ideal customers are going to be happier customers and happier customers are going to provide testimonials as well as references for future customers."

David Cummings

2) IT'S EASY TO USE

Great metrics need to be easy to use. By focusing on a small sample size, David's test makes it extremely easy to get a snapshot of progress towards PMF.

There's no need to dig out a monstrous spreadsheet, or wait for your customer base to swell to triple digits: you can get a rough-and-ready idea of Product/Market Fit in a few minutes.

Better yet, they're extremely actionable metrics: if you've failed at providing a bug-free experience, you need to hone in on product development; if new customers are missing out on tons of functionality, it's time to improve your onboarding process.

Cons of the David Cummings Product/Market Fit Test

1) IT'S LESS APPLICABLE TO B2C

Each of David's hallmarks of Product/Market Fit hinge on the experiences and engagement of 5-10 customers.

Whilst such a small sample size is great for usability, it does mean that the test is most relevant to the B2B sector. This is particularly true for those targeting the Enterprise, where a viable business can built with relatively few high-value customers; and the insights offered by such a small sample size can be useful enough to extrapolate from.

With a much lower Customer Lifetime Value (CLTV), B2C companies need a much larger number of customers to sustain their growth. To make this model more applicable to B2C SaaS businesses, the sample size needs to be increased (it's been estimated that a 10x sample size is enough to make these tests useful).

2) IT DOESN'T PROVIDE MUCH MARKET INSIGHT

If we return to the original definition of PMF, there are two criteria a Startup has to satisfy:

- Being in a good market

- Having a product which satisfies that market

With such a small sample size, it's difficult to extrapolate these findings to learn about the quality of the wider market. Instead, David's approach does a great job at assessing the second component of Product/Market Fit.

'Satisfying the market' goes beyond delivering value to a handful of customers - you need to be consistent and predictable with that value. By focusing on a handful of users, David's criteria ensure that Startups create value in the right way.

By satisfying each of these five criteria, you can rest assured that your startup is attracting the right types of customers - and crucially, providing value to them in a scalable way.

How to Create a Product/Market Fit Survey

In the early days, the success of your SaaS startup hinges upon a single question: have you built a product people want, or are you still a product pivot away from success?

To help you get the answers you need to scale with confidence, I've outlined a simple 5-step process (complete with free template) for creating a Product/Market Fit survey.

1) Choose Your Survey Questions

We're going to use the Sean Ellis approach to Product/Market Fit (PMF) as the basis of our survey (for the reasons behind this choice, you can check out my in-depth analysis here).

Sean's PMF test relies on a simple, customer-focused question:

How would you feel if you could no longer use [product]?

- Very disappointed

- Somewhat disappointed

- Not disappointed (it really isn’t that useful)

- N/A - I no longer use [product]

Instead of relying on quantitative data and metrics (which can be extremely variable when startups have a small customer base to draw from), it offers a simple, straightforward way to get to the crux of the issue: do your customers care about your product?

Though deceptively simple, the answer to that question can imply a lot about the types of people you're targeting, the problem you're solving, and the value those customers place on your solution.

For additional context, we're also going to supplement our survey with a few extra questions. In Buffer's PMF surveys, they ask for elaboration on the main survey question...

Please help us understand why you selected that answer.

...Hiten Shah takes the opportunity to gain some valuable competitor insight...

What would you likely use an alternative if [product] were no longer available?

...and Baremetrics ask about customer referrals.

Have you recommended [product] to anyone?

I've included all of these questions (and a couple extra) in the free Product/Market Fit survey I've created to go alongside this post.

2) Find 40-50 People to Survey

The next step is to identify customers to send the survey to.

In terms of determining the sample size, the more people you can survey, the more significant your findings will be. Obviously, there's a caveat: as a small, potentially pre-Product/Market Fit startup, you might not have huge numbers of paying users.

For a rough benchmark, 40-50 responses should prove enough to carry significance. If that simply isn't an option, it might be worth augmenting your survey with an alternative indicator of PMF (more on that later).

It's also important to reach out to the right type of people.

When Buffer wanted to determine whether their latest product offering had hit PMF, they reached out the tool's beta users:

Upon reflection, they realised that the overwhelmingly positive response from these highly-engaged, highly evangelical users wouldn't necessarily be reflective of the responses of Buffer's "average" customer.

To try and alleviate this kind of bias, it's crucial that your survey respondents are:

- Paying customers.

- Users of the core functionality of your service.

- Recently active (ideally within the last 2 weeks).

3) Send the Survey

Armed with your survey questions and a list of right-fit customers, it's time to get the survey launched. There are a few different ways you can go about this, from in-app messaging to dedicated surveying tools:

- HubSpot

- Typeform

- Google Forms

If you're looking for the easiest way to get going, just use the free Product/Market Fit survey I've created, and simply download, tweak, and email to your customers.

4) The Big Reveal

When you've received enough survey responses, it's time to analyse your findings. The threshold we're looking to cross with this PMF survey is 40% of your respondents (or more) answering "Very disappointed" to the question "How would you feel if you could no longer use [product]?" With a sample size of 50 respondents, that's 20 people.

40%+

If over 40% of your surveyed users would be "very disappointed" if they could no longer use your product, you have a great indication that your product is problem-solving and valuable. Though not a guarantee of Product/Market Fit, these factors are a necessary prerequisite to scaling your business.

<40%

If you don't manage to hit the Product/Market Fit threshold, don't despair: achieving PMF is a challenge for any new product, and the more innovative and disruptive you are, the harder it will be to validate your direction.This survey will provide you with a benchmark to compare against future performance. If you've included some open-ended questions in your survey, you can use those responses to dig into the problems that have prevented your customers from really "clicking" with your product.

This 40% benchmark was determined by comparing results across 100s startups.

Those that were above 40% are generally able to sustainably scale the businesses; those significantly below 40% always seem to struggle.

Sean Ellis, Survey.io

5) The Next Step

From Sean Ellis' findings, the 40% benchmark is a necessary prerequisite to Product/Market Fit; but, as you might expect from a simple survey question, it doesn't guarantee it.

To increase your confidence in your findings, there are a couple of ways you can augment your survey:

- Combine it with David Cumming's approach to Product/Market Fit: a checklist of 5 characteristics of post-PMF SaaS companies.

- Send a follow-up survey to your respondents to learn more about the motivations behind their choices (this is something I've facilitated in the free template that accompanies this post).

- Analyse the respondents' in-app usage data to try and identify problem areas and sticking-points.

All of this information works together to paint a picture of your Product/Market Fit: but even if you're certain you've hit PMF, this type of proactive customer development work should be an ongoing commitment.

Achieving Product/Market Fit isn't a goal in its own right - but understanding and validating the role your product plays, in your customers' lives and the market as a whole, should be.