From HubSpot to Salesforce, Bird to Dropbox, fairytale stories of billion-dollar SaaS startups seem to be everywhere. In each instance, there's a particular fascination on two pieces of information: the company's staggering valuation, and the investment they secured to get there.

In fact, the link between funding and startup success seems so ubiquitous that many startup founders race headlong into the maw of waiting investors without a second's hesitation. But to work out the exact relationship between startup fundraising and the phenomenal growth these companies have achieved, we need to dig deep into the world of startup funding.

To get started, we're answering two crucial questions: why do startups actually raise investment? And is startup funding a prerequisite of success?

Last updated in July 2024

Why Raise Investment?

A startup is a company designed to grow fast. Being newly founded does not in itself make a company a startup. Nor is it necessary for a startup to work on technology, or take venture funding, or have some sort of "exit." The only essential thing is growth. Everything else we associate with startups follows from growth.

Paul Graham, Y Combinator

The Startup DNA

To answer these questions, we need to dig into the DNA of a startup. Today, the word startup is used to refer to everything from post-IPO tech giants to self-funded artisanal bakeries. In its original use case, the term startup referred to a company with a single defining attribute: it was designed to grow fast.

To answer these questions, we need to dig into the DNA of a startup. Today, the word startup is used to refer to everything from post-IPO tech giants to self-funded artisanal bakeries. In its original use case, the term startup referred to a company with a single defining attribute: it was designed to grow fast.

Many of the characteristics we associate with successful startups (like venture funding, a big exit and the software-as-a-service business model) aren't prerequisites, but are actually side-effects of this overall pursuit of growth.

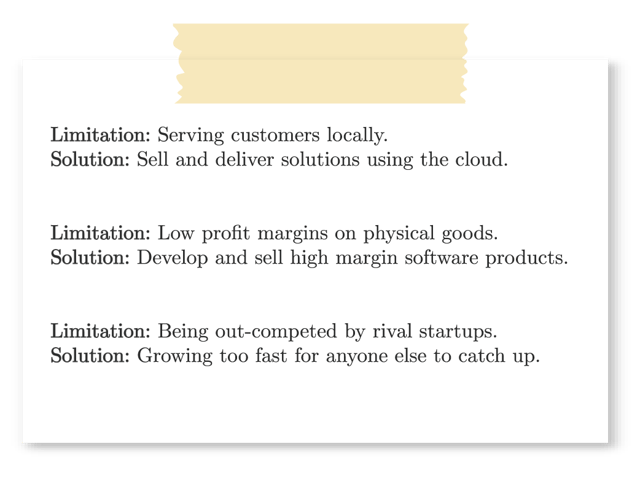

To understand how today's archetypal startup evolved, let's consider some of the problems that could limit a new company's growth:

In other words, the defining traits of today's most successful SaaS startups (companies like HubSpot, Salesforce and Bird) evolved as solutions to the singular problem of growth.

This is why fundraising is part-and-parcel of the trajectory of most successful startups: it provides the resources needed to achieve rapid growth.

Fundraising vs Bootstrapping

Funded or not, there are a handful of significant costs that all startups will have to pay for, even in the early days:

1) Ongoing product development

From MVP to polished product, ongoing development is likely to be one of the biggest costs facing your startup.

2) Hiring

Whether you need to recruit a co-founder, first employee or VP Sales, top talent is essential for any successful startup.

3) COGS (Cost of Goods Sold)

COGS refers to unavoidable expenses associated with selling and delivering your solution. In SaaS, these are expenses like regulatory and licensing costs, application hosting fees and customer support.

4) Physical premises

There's only so long you can work out of your garage.

A self-funded (or bootstrapped) company has little choice but to pay for these costs out of revenue, creating a real-life Catch-22 situation: you need revenue to fund product development, and product development to generate revenue.

It's still possible to reach the same heady heights as funded companies (Atlassian and Qualtrics were bootstrapped to IPO/near-IPO status), but it'll be longer before you can make key hires, relocate, or ramp-up your product development, sales and marketing spend.

...it takes much longer, usually, to get to Initial Scale ($10m ARR).

Usually 4 years longer when you are bootstrapping.

Jason Lemkin, SaaStr

The Problem of Competition

This becomes a real problem when you have rival startups that manage to secure funding. They'll have access to a ton of capital, and won't have to make the same compromises as you:

- While you're hiring a remote developer, they'll hire ex-Google employees.

- While you're building out a beta waiting list, they'll be pulling in revenue.

- While you're stuck in a basement in the Middle-of-Nowhere, they'll be networking in the Valley, or the Bay Area.

Straight from the get-go, a funded company has a huge advantage over a bootstrapped company. Even if you'd be happy to take your time, and grow from revenue, you might have your choice taken away from you if a rival company opts for funding.

In a competitive ecosystem, you can bootstrap your startup to success - but it's likely to be quicker, and safer, to accelerate the process with investment.

Recommended Reading

SaaS Startup Funding Rounds

Venture funding works like gears. A typical startup goes through several rounds of funding, and at each round you want to take just enough money to reach the speed where you can shift into the next gear.

Paul Graham, Y Combinator

Few startups get it quite right. Many are underfunded. A few are overfunded, which is like trying to start driving in third gear.

I think it would help founders to understand funding better—not just the mechanics of it, but what investors are thinking.

The Fundraising Journey

So far we've covered the why of funding. Now we can start to cover the how, and look at the process startups go through on their fundraising journey.

The last decade has seen a few persistent trends reshape the way startups raise investment. To fully understand why modern-day investment looks the way it does, we need to get to grips with these changes:

1) Investment has increased massively

There are peaks and troughs in fundraising, typically driven by exuberant over-investment followed by reactive belt-tightening. But despite these fluctuations, the overall growth trend for fundraising is hugely positive: year-on-year, startups are raising more capital at higher valuations.

2) If there's a bubble, it hasn't burst

The escalation of company valuations and ever-increasing round sizes has led many to speculate about an investment bubble. So far though, the data shows that current slowdowns have been short-lived.

3) The earlier the round, the riskier it is

Perceived risk levels impact the types of investors attracted to a deal, and the amounts raised: expect early-stage investment to attract risk-loving angels and VCs, and later-stage fundraising to appeal to risk-averse financial institutions.

4) Most investment takes place in the enterprise

80% of venture capital investments happen in the enterprise, with the lion's share of those investments going to enterprise software - second only to the burgeoning biotech industry.

5) "Seeds are the new Series A"

This continued increase in investment has created a kind of fundraising inflation, with startups expected to work harder for each round of investment than ever before. We've even seen the introduction of a new term into the fundraising lexicon: pre-seed investment.

Pre-Seed

Seed rounds are typically regarded as the first type of fundraising round available to founders. But in an increasingly competitive marketplace, huge growth in the number of startups has allowed "traditional" seed investors to become far more discerning in how they choose their investments - raising the threshold required to attract "traditional" seed funding.

Seed rounds are typically regarded as the first type of fundraising round available to founders. But in an increasingly competitive marketplace, huge growth in the number of startups has allowed "traditional" seed investors to become far more discerning in how they choose their investments - raising the threshold required to attract "traditional" seed funding.

A typical pre-seed round sees a founding team (often pre-product) receive a small investment to hit one or more of the milestones they'll need to ready themselves for "true" seed investment: from hiring a critical team member to developing a prototype product.

Led by many of the same investors that lead seed rounds, pre-seed financing is often used to bridge the gap to the next round.

Average Funding Amount: <$1 million

Typical Company Valuation: $1-3 million

Common Investors: Friends and family, early-stage angels, startup accelerators

A pre-seed is an early round of financing that is designed to help a company achieve certain intermediate milestones PRIOR to the magic combination of strong PMF + meaningful traction.

Rob Go, NextView Ventures

Seed

Capital from a seed round often fuels a startup's move beyond its founding team, funds product development, and in some cases, even facilitates early revenue generation.

Wrapped-up within seed investment are expectations that strong signs of Product/Market Fit and some some degree of traction (in the form of a growing wait list, or month-on-month revenue growth) will begin to emerge, paving the way for later fundraising.

Traditionally, seed rounds were the reserve of angel investors, but the proliferation of cash-rich VC funds and a huge range of startups to invest in has attracted more venture capital firms into seed round investment.

This has created a huge variance in seed sizes: the median angel-funded seed size is around $150,000, but the median VC-led seed size is closer to $1.5 million. The involvement of VCs leads to seed rounds ten times larger than those led by angels - with supergiant seed rounds now becoming more common.

Average Funding Amount: $1-4 million

Typical Company Valuation: $3-12 million

Common Investors: Angels, early-stage VCs, startup accelerators

Series A

Revenue growth is the name of the game in Series A. By this point, a SaaS startup is expected to have clear and growing evidence of Product/Market Fit, translating into significant revenue growth from new customers and increasing ARPA (Average Revenue per Account).

Revenue growth is the name of the game in Series A. By this point, a SaaS startup is expected to have clear and growing evidence of Product/Market Fit, translating into significant revenue growth from new customers and increasing ARPA (Average Revenue per Account).

It's also here that SaaS marketing and sales become more important. Until this point, growth has often been driven by a single (and not always scalable) channel. To keep growing at a rapid rate, it's necessary to develop new sales and marketing processes, identify new channels, and get to grips with your ideal customer.

Angels (often referred to as "super" angels) will sometimes invest in Series A rounds, but it's usually the venture capital organisations that dictate this round. The increasing involvement of VCs also means that Series A rounds are rapidly increasing in size (Spellbook for example recently raised a Series A worth $20 million).

Average Funding Amount: $4-15 million

Typical Company Valuation: $12-45 million

Common Investors: VCs, "super" angels

Series B

The previous rounds have been fuelled by relatively tentative signs of progress, from a promising idea, through leading indicators of Product/Market Fit, to early traction and the first signs of revenue growth.

The previous rounds have been fuelled by relatively tentative signs of progress, from a promising idea, through leading indicators of Product/Market Fit, to early traction and the first signs of revenue growth.

In Series B, investors are looking for the next stage of growth: the ability to take everything you've learned, and make it work at scale.

In practical terms, Series B investment might allow a startup to make expansive hires (across business development, strategic accounts, marketing and customer success), expand into different market segments or experiment with different revenue streams, and in dramatic instances, even buy-out businesses that offer a competitive advantage.

Average Funding Amount: $15-40 million

Typical Company Valuation: $75-200 million

Common Investors: VCs, late-stage VCs

Series B is hard for a simple reason: suspension of disbelief fades and is replaced by an increasingly cold, hard look at milestones and progress. Series B is the round where the rubber meets the road, where the promise has to be met with numbers and projections.

Fred Destin, Accel Partners

Series C+

Series C rounds are raised to fuel large-scale expansion, like moving into a new market (commonly international expansion), or to fuel acquisitions of other businesses.

Series C rounds are raised to fuel large-scale expansion, like moving into a new market (commonly international expansion), or to fuel acquisitions of other businesses.

After Series C, there's theoretically no limit to the number of investment rounds a startup can raise: some companies will go on to raise investment through Series D, E and beyond. Given the relatively low number of startups that make it to this point, there's also a huge amount of variance in the amounts raised, with investment determined on a case-by-case basis.

At this late stage, the business is also de-risked enough for financial institutions to involve themselves in investment. These players often bring huge chequebooks to bear on financing rounds, generating truly staggering round sizes. In 2021, MessageBird raised a reported $1 billion in its own series C.

Average Funding Amount: $40 million+

Typical Company Valuation: $200 million+

Common Investors: Late-stage VCs, private equity firms, hedge funds, banks

The late stage...investors are hunting for breakout companies that have serious traction. But there are few companies that breakout, and there is a high supply of capital looking to invest in the companies. The low supply and high demand is driving up the valuations and deal sizes.

Manu Kumar, K9 Ventures

Recommended Reading

SaaS Startup Investors

From the world of startup incubators to the glamour of the New York Stock Exchange, startup fundraising is fuelled by a diverse array of investors. From philanthropic ex-founders to massive financial institutions, your choice of investor has far-reaching consequences for the capital, guidance and direction you can expect from each funding round.

So to help you understand the different types of investor (and their different agendas), it's time to separate out the incubators from the accelerators, and the micro-VCs from the super-angels.

Startup Incubators & Startup Accelerators

Famous examples: Y Combinator, 500 Startups, Techstars, AngelPad

A startup incubator supports new ventures during the idea stage, providing access to the infrastructure and environment required for developing a Minimum Viable Product (MVP). With no offer of funding (and no expectation of equity in return), proven performance isn't a prerequisite, with incubators collaborating with their participants for anywhere from a few months to several years.

In contrast, startup accelerators are a fast-track towards further funding. They offer capital in exchange for equity in your company (usually up to a maximum of 10%), and for a period of several months, provide a crash-course in growth and fundraising designed to accelerate your existing growth. After "graduation", an accelerator's alumni are expected to have honed their performance metrics and pitch, and be ready to raise a full seed round.

The accelerator journey is not an all-inclusive road to success. Rather, it is meant to help you get to a point at which you’re ready to raise larger amounts of capital. The goal of accelerators is to grow the size and value of a company as fast as possible in preparation for an initial round of funding.

Bill Clark, MicroVentures

Pros of Startup Incubators & Accelerators

- Mentorship. The best accelerators and incubators provide advice and guidance from some of the smartest startup minds around.

- Access to future investment. Accelerators offer a direct and reliable route to investment, with many backed (and mentored) by VCs, angels and seasoned founders.

- Credibility and social proof. Acceptance into Y Combinator or 500 Startups' latest batch is guaranteed to boost the visibility of your startup.

Cons OF STARTUP INCUBATORS & ACCELERATORS

- Hugely over-subscribed. The best incubators and accelerators are incredibly popular: both Y Combinator and Techstars only accept 1 to 2% of applicants.

- Varying quality. With the top names so over-subscribed, newer incubators and accelerators open all the time. While some offer great value guidance and support, others offer a fast-track to the startup graveyard.

- Expensive. Equity is an expensive commodity to trade for relatively low amounts of capital.

Angel Investors

Famous examples: Jeff Bezos, Paul Graham, Kevin Rose, Dharmesh Shah

Angel investors are wealthy individuals that offer capital to early-stage startups, in exchange for an equity share in the company. Given the relative volatility of angel investing (it's hard to pick a winner at such an early stage), many angels pair financial motives with a philanthropic bent - often resulting from their own entrepreneurial background.

Angels, like most types of investor, need an exit to make their investment work: in order to "free-up" the money they've spent on you, and unlock their profits, they need you to A. sell your company, or B. go public.

Angel investors are typically well-connected, wealthy individuals.

They generally use their own money... they don’t go on boards, they don’t need to put in lots of capital (in fact, they usually don’t want to), they prefer dead simple terms (as they often don’t have legal support), they understand the experimental nature of the idea, and they can sometimes decide in a single meeting whether or not to invest.

Ben Horowitz, Andreessen Horowitz

Pros of Angel Investors

- They'll take risks other investors won't. Angels have a higher tolerance for risk than most other investors. If your fledgling startup needs someone to take a chance on it, chances are, angels will be the ones to supply the capital.

- Flexibility. Angels don't operate to the same limitations as VCs and financial institutions (one of the pros of investing your own money), and can often flex investment terms for the benefit of both parties.

- Experience. Many of the best angels are former founders, and bring their own experience (and network) to the table.

- Quick Decisions. Without other investors or a board to answer to, angels can make investment decisions extremely quickly - perfect if you're running out of runway.

Cons of Angel Investors

- It's still expensive. Giving away early-stage equity can be extremely costly, especially if you're trying to court a big-name angel with preferential investment terms.

- Not all angels are created equal. Without other investors to be accountable to, it's easy for an angel to take advantage of a naive founder. There's also huge variance in the time, energy and expertise individual angels will be willing to invest in your startup.

- Pockets aren't always deep enough. Though wealthy, angels will still have less capital available for investment than VC funds or financial institutions. At some point, you'll outgrow their support.

- They need a big return. Early-stage angel investments are high risk, and future investment can heavily dilute an angel's equity. The best way to compensate this? A 10x return on their investment.

Venture Capital Firms

Famous examples: Andreessen Horowitz, Sequoia, Point Nine, Redpoint

Unlike an angel, venture capital (VC) firms invest using a fund: a pool of money provided by the company's own investors (typically referred to as Limited Partners) and the fund's managers (or General Partners).

The VC's job is to invest that money into promising new startups, often over the course of a decade, and generate a return for both themselves and their investors. VCs offer their capital in exchange for equity, and like angels, require an eventual "exit" (usually an IPO, merger or acquisition) to generate a return on their money.

The size of the VC's fund will determine the size of return required, impacting both the amount they'll invest, and the types of companies they'll invest in.

When deciding if to raise a venture round, it’s critical to ensure your venture investor shares the vision for the company: both the product roadmap and the financial goals of the company.

Most founders never consider the impact of fund size on VC motivations... But this is naive. Fund sizes dictate a VC’s strategy. To achieve their target returns, a $50M fund and a $500M fund must pursue very different investment and management styles.

Tomasz Tunguz, Redpoint

Pros of Venture Capital Firms

- Advice and experience. VC's have a (literally) vested interest in your success, and that often translates into more guidance and advice than angels would be willing to offer.

- Access to a ton of capital. VCs have far deeper pockets than the average angel (or even super angel).

- Network effect. Working with a big-name VC offers credibility, social proof, and most important of all, access to their personal network of experts.

- Clear path to follow-on investment. Most VCs are in for the long-haul, and will lead subsequent rounds of funding (more on this topic later).

Cons of Venture Capital Firms

- They need massive returns. Venture investments are risky, and there are huge amounts of capital at stake, both of which translate into the firm's Limited Partners expecting pretty serious returns. If we dig into the maths of how large VCs operate, it quickly becomes clear that "successful" investments won't cut it - they need mega-successes just to survive.

- They need control. With investors to appease and investments to justify, VCs don't just want more control over the direction of your company - they need it, usually in the form of board seats.

- They're more risk averse than angels. VCs are after proven performance and water-tight metrics, and their due diligence process can take a seriously long time.

- Conflict of interests. What you want to do as a founder doesn't necessarily align with what your VC investors want.

Equity Crowdfunding

Famous examples: Indiegogo, CrowdCube, Crowdfunder, Seedrs

The "traditional" crowdfunding model operated by companies like Kickstarter is known as reward crowdfunding - allowing people to pre-purchase goods and services, in exchange for select rewards. Though great for hardware startups (like the Pebble smartwatch), without a physical product to sell, this type of fundraising wasn't viable for SaaS startups - until equity crowdfunding appeared.

Equity crowdfunding allows individuals to invest small amounts of capital in exchange for a small share in equity. While many equity crowdfunding platforms allow anyone the chance to invest, others offer the opportunity to contribute to angel- or VC-lead rounds, providing a hybrid funding model that combines expert experience with crowd-sourced funding.

As with other types of equity-based funding, for investors to make any money, they require an eventual exit: selling their shares in the event of a merger, acquisition or even IPO.

We don't see crowdfunding and venture capital as mutually exclusive. We're seeing Indiegogo become an incubation platform for traditional financiers to come in and discover new ideas...

A successful crowdfunding campaign helps prove to VCs, angel investors and banks that there is a demand for a product in a marketplace, removing some of the risk from the equation.

Danae Ringelmann, Indiegogo

Pros of Equity Crowdfunding

- Set your own terms. Equity crowdfunding affords you the freedom to raise what you want, how you want, without the added complications of investors trying to steer your ship.

- Relatively fast. Most equity crowdfunding platforms give startups 30-60 days to raise investment.

- Democratise investment. Startups like to disrupt, and take-down big, inefficient businesses, so it's no surprise that the idea of democratising investment would prove to be a big attraction for many founders.

- Crowdfunding is evolving. This type of fundraising is in its infancy, but as more companies facilitate crowdfunded investment, more options appear: affording founders never-before-seen flexibility to raise capital in a way that suits them.

Cons of Equity Crowdfunding

- Capital is pretty restricted. As it stands, regulations on crowdfunding are pretty tight, with restrictions imposed on the number of investors you can have, and the amount of capital you can raise (currently capped at $1 million in the US).

- Hidden fees. It's common practice for equity crowdfunding platforms to charge fees for facilitation and payment processing. Though relatively small, these charges can quickly add up.

- Easy to trivialise. Without lengthy due diligence or a drawn-out fundraising process, it might be easy to underplay the impact of equity crowdfunding. As with all investment types, it needs to be approached with caution and planning.

- Lack of guidance. For many fledgling startups, expert guidance from experienced VCs or angels can prove to be as valuable as the capital they provide. With most types of equity crowdfunding, you're on your own.

IPO (Initial Public Offering)

Famous Examples: Salesforce, LinkedIn, Workday, HubSpot

When a company reaches a certain size, continued growth requires a serious injection of capital: too much even for VCs to contribute. It's here that some companies will consider an Initial Public Offering, and transform into an organisation that anyone can invest in.

Often called a stock market launch, in practical terms this means transforming from a privately held company into a public one, selling a portion of shares to institutional investors (like banks, insurers and hedge funds) who then make the shares available for purchase on the public stock exchange.

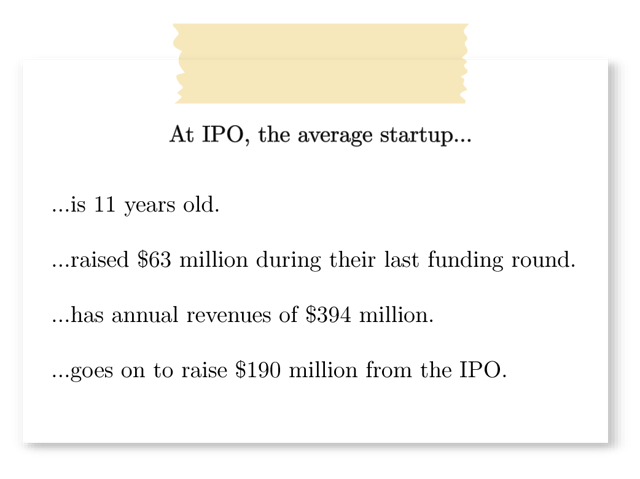

So what does an "average" startup look like at IPO? Data from Equityzen has the answer:

The biggest "holy crap!" moment happened the morning of the bell-ringing ceremony. My wife Kirsten and I were walking up Wall Street on our way to the exchange building. Then, we saw the HubSpot logo draped over the entire building. Was not expecting that. We were floored. It was *awesome*.

Dharmesh Shah, HubSpot

Pros of an Initial Public Offering

- Massive funding potential. Big angel and VC investments can net a growing startup millions of dollars in investment - but an IPO can raise billions.

- Liquidity. IPOs often make it possible for founders and other investors to sell their shares. As well as rewarding the startup's long-standing investors, this helps free up liquid capital for the company to spend in other areas of growth.

- Attract talent. Raising an IPO also makes it possible to offer stock options as incentive for top talent.

- You did it. For many people, hitting IPO is the ultimate hallmark of success.

Cons of an Initial Public Offering

- It's expensive. The average cost of an IPO is $3.7 million, and with a whole plethora of regulatory commitments to adhere to, it's estimated to cost $1.5 million per year just to function as a public company.

- Loss of control. Public companies often have thousands of shareholders, each with voting rights. Performance needs to be reported, each and every quarter, and poor performance will need to be answered for.

- It's a different job. Running a public company is a very different job to the one most startup founders sign-on for.

Recommended Reading

- How to Fund a Startup - Paul Graham

- Accelerators vs. Incubators: What's the Difference? - MicroVentures

- Should You Join a Startup Incubator or Accelerator? - Cobloom

- Angels vs. Venture Capitalists - Ben Horowitz

- Why VCs Need Unicorns Just to Survive - Jason Lemkin

- The Day I Had to Wear Pants to Ring the IPO Bell - Dharmesh Shah

Pitching to SaaS Investors

Investors see a lot of pitches. In a single year, the classic general partner in a venture firm is exposed to around 5,000 pitches; decides to look more closely at 600 to 800 of them; and ends up doing between 0 and 2 deals. The goal of an entrepreneur is to be one of those deals.

Reid Hoffman, LinkedIn

Your startup needs funding. To secure it, you need to stand-out from the hundreds of other startups that also need funding, and convince investors that you aren't destined to fall into the 90% of newly-founded companies that eventually fail.

But big-name angels and VCs find themselves overwhelmed with investment opportunities. You'll need to convince associates and analysts before you reach the decision makers. Even then, you'll have a matter of minutes to make them fall in love with your company and open their chequebook.

To help separate the donkeys from the unicorns, most investors rely on a simple tool: the pitch deck. This short slide presentation is designed to convince potential investors that your startup represents an unmissable opportunity.

Principles of Pitching

Remember that most people are visual thinkers and Powerpoint slides simply help frame the conversations. The best ones are visual, high-level... move swiftly, are designed to prompt questions as much as “pitch” your company and importantly have a narrative.

Mark Suster, Upfront Ventures

It's important to remember the driving force behind your presentation: you're not telling your life's story, or providing a blow-by-blow account of every customer you've ever closed. Instead, your only objective is to stimulate enough interest to secure a second meeting.

The principles of great presentations are pretty universal, but there are a few fundraising-specific best practices that should be incorporated into your pitch:

1) Keep it Short, Sweet and Simple

Data from DocSend found that investors spend an average of just 3 minutes and 44 seconds viewing your perfectly crafted pitch deck. That means brevity is critical: stick to one idea per slide, and between 10 and 30 slides in total (the average deck in DocSend's study was 19.2 pages long).

2) Less Telling, More Showing

This means using less wordy copy, and more diagrams and visualisation; less conjecture and more data. Stick to big font sizes and simple concepts, and be prepared to add context and clarity when asked.

3) Be Honest

Your startup isn't perfect, and investors know that. Instead of whitewashing your success, be honest about your strengths and weaknesses. Steer into areas that need work and frame them in your own terms, and double-down on the areas where you excel.

4) If You Focus on Finances, Make Them Inscrutable

Only 57% of the decks studied actually included a finances slide, but for those that did, it was their most scrutinised slide. If you're going to brave it, make sure your numbers make sense (and don't talk about exponential growth rates with only a few months of data).

5) Sell Your People, Not Just an Idea

Angels and VCs invest in people: they want to know they'll be funding highly-skilled, deeply-committed founders, and your presentation needs to sell your team as much as it does your product. With that in mind, it's a great idea to have 2-3 people in attendance, and involve them equally in the pitch.

Recommended Reading

Understanding Startup Equity

Most founders start out owning their company. But to grow as quickly as possible, you'll need investment, and to secure the capital you'll need, your investors will want to own a part of your company.

The faster you grow, the greater your burn rate becomes, and the more capital you'll need. You move from pre-Seed to Seed to Series A, but with every cash injection you're forced to give up another slice of your company. Offer too little, and the investment dries up - offer too much, and you'll soon find yourself without a share in your own company.

In my experience, it will generally take three to four rounds of equity capital to finance the business and 20-25% of the company to recruit and retain a management team. That will typically leave the founder/founder team with 10-20% of the business when it's all said and done.

Fred Wilson

The Problem of Dilution

Company ownership is determined by shares. In the early days, it's likely you (and your co-founders) will own 100% of your startup's shares:

$$\text{Founder: }\frac{100}{100}\text{ shares (100%)}$$

But in order to give equity to investors, your startup needs to issue new shares. If an angel invested an amount equal to 20% of the value of the company, you'd need to issue shares to reflect his ownership stake: in this case, an additional 25 shares.

You still own your original 100 shares, but now, the company's ownership looks like this:

$$\text{Founder: }\frac{100}{125}\text{ shares (80%)}$$

$$\text{Angel: }\frac{25}{125}\text{ shares (20%)}$$

Jump ahead to the next funding round. This time, a VC invests an amount equal to half the value of the company.

Assuming equal dilution (which might not always be the case), you'll need to issue 125 shares to reflect the VC's ownership stake.

$$\text{Founder: }\frac{100}{250}\text{ shares (40%)}$$

$$\text{Angel: }\frac{25}{250}\text{ shares (10%)}$$

$$\text{VC: }\frac{125}{250}\text{ shares (50%)}$$

As a result of just two rounds of investment, you've gone from owning 100% of your company, to 80%, to just 40%. If you aren't careful, subsequent rounds of investment can leave you so diluted that you'll lose control of board seats, and even the company's direction.

Anti-Dilution Practices

This apparent horror story leads many founders to take staunch anti-dilution measures. But dilution serves a purpose: to attract skilled people and resources to your startup.

Whether it's incentivising a respected VC with a sizeable ownership stake, or luring top talent with an options pool, offering equity is beneficial to your startup, and attempting to hold on to as much equity as possible could limit your growth. Taken to an extreme, anti-dilution practices could leave you as the majority shareholder of a worthless company.

A balance needs to be struck, between incentives and control, investment and ownership: but how do we find that balance?

Pre-Money and Post-Money Valuation

Let's assume both you and your investor have valued your early-stage startup at $100,000. Your investor is willing to contribute $25,000 to fund the growth of your company. How much equity should they get?

This depends on the nature of that $100,000 valuation. If the angel's $25,000 investment is included in the valuation (known as a post-money valuation), they'll own 25% of the company, reducing your share to 75%:

Post-money Valuation

$$\text{Angel: }\frac{25000}{100000}=25%$$

$$\text{Founder: }\frac{75000}{100000}=75%$$

If that $100,000 is a pre-money valuation, the company is valued at $100,000 before the investment. That means that the angel's investment actually serves to increase the value of the company to $125,000, reducing their share to 20% and increasing yours to 80%:

Pre-money Valuation

$$\text{Angel: }\frac{25000}{125000}=20%$$

$$\text{Founder: }\frac{100000}{125000}=80%$$

In both instances you've gained the capital you need to grow, as well as the expertise of a seasoned angel; the only difference is how their investment has affected your ownership. In the first example you've lost 25% ownership and $25,000 in valuation; in the second example you've lost 20%, and maintained the valuation.

Equity and Valuation

Jump ahead to the next investment round. This time, promising growth has your company valued at $1 million. Given your current equity split, the value of your ownership stake looks like this:

$$\text{Angel: }1\text{m}\times20%=200000$$

$$\text{Founder: }1\text{m}\times80%=800000$$

You're talking to a VC who's looking to invest $500,000, for a post-money valuation of $1.5 million. That gives the VC a one-third share in your company, diluting both your shares and the angel's shares proportionately:

$$\text{VC: }\frac{500000}{1.5\text{m}}=33.3%$$

$$\text{Angel: }\frac{200000}{1.5\text{m}}=13.3%$$

$$\text{Founder: }\frac{800000}{1.5\text{m}}=53.3%$$

But valuations, try to account for future value. If your startup is doing particularly well, you may end-up in a bidding war, so what happens if a VC thinks your company is actually worth $2 million?

After all, the only real valuation of a company is whatever someone is willing to pay for it, and a VC will pay huge amounts if they think you'll be worth a whole lot more in the future.

Let's work through the same example with a $2 million pre-money valuation. In light of this valuation, the value of your existing shares has doubled:

$$\text{Angel: }2\text{m}\times20%=400000$$

$$\text{Founder: }2\text{m}\times80%=1.6\text{ million}$$

That same $500,000 investment now creates a post-money valuation of $2.5 million, reducing the VC's share from one third of the company to one fifth.

$$\text{VC: }\frac{500000}{2.5\text{m}}=20%$$

$$\text{Angel: }\frac{400000}{1.5\text{m}}=16%$$

$$\text{Founder: }\frac{1.6\text{m}}{2.5\text{m}}=64%$$

In this instance, your equity has been diluted by 16%; but 64% of $2.5 million is larger than 80% of $1 million. Despite the dilution, the value of your share has doubled:

$$\text{Founder: 2.5m}\times64%=1.6\text{m}$$

$$\text{Founder: 1m}\times80%=800000$$

Better still, you've gained a VC, and the capital required to grow further. This is the basic premise of investment done right: even though your overall share of the company decreases, the company grows enough from the investment to increase the value of that share.

The Equity Equation

Investment decisions can become incredibly complicated, and in the case of successful startups, minute changes to ownership stakes can equate to millions of dollars. Thankfully, there's a simple rule of thumb we can use to work out whether or not we think an investment opportunity is worthwhile.

In the general case, if n is the fraction of the company you're giving up, the deal is a good one if it makes the company worth more than 1/(1 - n).

Paul Graham, Y Combinator

For example, suppose Y Combinator offers to fund you in return for 6% of your company. In this case, n is .06 and 1/(1 - n) is 1.064. So you should take the deal if you believe we can improve your average outcome by more than 6.4%. If we improve your outcome by 10%, you're net ahead, because the remaining .94 you hold is worth .94 x 1.1 = 1.034.

An investment deal is worthwhile if you believe the deal will increase the value of your shares in the long-term by more than it reduced it in the short-term. Put another way:

The optimal amount raised is the maximal amount which, in a given period, allows the last dollar raised to be more useful to the company than it is harmful to the entrepreneur.

Pierre Entremont, Otium Capital

Though there are no hard-and-fast rules for separating out a good deal from a less-than-good deal, these heuristics can be useful for understanding what you stand to gain... and lose.

As a final word on startup equity, remember: dilution is normal. By the time they exit, successful founders often own as little as 10% of their company - and owning 10% of a billion-dollar startup is better than 100% of nothing.

Recommended Reading

SaaS Valuation Methods

Whether it's the capital on offer, the equity investors demand, or simply their willingness to invest, every aspect of startup funding is tied together by one seemingly inscrutable concept: valuation.

The perceived value of your startup is the linchpin of every investment negotiation you'll ever have, and understanding exactly how investors value your startup is the first step in securing great investment terms.

With that in mind, we're exploring the most common methods of startup valuation, and looking at how they impact your equity, ownership and investment options.

Early Stage vs Late Stage Valuation Methods

Many of these valuation methods are extremely subjective, and even those that rely on bona fide accounting principles still have a subjective element built-in, for one very simple reason: value is subjective. Even with an inscrutable data-set, a startup's value is determined by the amount somebody is willing to pay for it.

It's for that reason that startup valuation methods are often blended together, edited and altered to reach a particular conclusion. This is never more evident than in the case of early-stage startup valuations.

Large, established startups have the benefit of tangible revenue, and valuations can be driven by their past performance. But investors often invest before companies make profit, or even generate revenue. In these instances, the startup valuation methods used are incredibly subjective, relying on heuristic stand-ins for revenue.

As you're about to see, there's no such thing as a truly objective valuation. So if you find yourself on the wrong end of a low valuation, dust yourself off, work out how the investor reached their conclusion, and try again.

1) The Comparables Method

The comparable method of startup valuation is probably the simplest: find a comparable company to the one you're trying to value, and use its valuation as a stand-in for the new startup.

In the same way that two houses might have their size, layout and outside space compared, two startups might have their MAU, churn rates and MRR growth compared to create a stand-in valuation:

"Startup X is worth $4 million, and Startup Y is comparable to Startup X, so the same valuation applies".

There are obvious problems with this methodology - few startups are likely to be similar enough to warrant this approach as a sole method of valuation - but for many investors, this offers a starting point for assessing the value of early (pre-revenue) stage startups.

2) The Conformity Method

Startup accelerators like Y Combinator are incredibly oversubscribed, and that affords them the freedom to set their own valuation methodology: a one-size-fits-all approach that massively simplifies investment.

This usually takes the form of a fixed investment in exchange for a fixed equity share. To be accepted into the program, the investor's terms need to be accepted - and if a founder doesn't like the deal they're offered, there are a few hundred other founders queuing behind them to take their place.

Y Combinator has done a lot to ensure the fairness of their particular deal, and their approach completely removes the problem of valuing early-stage startups. Each startup is offered the same amount, for the same share, giving all Y Combinator companies a pre-money valuation of just over $1.7 million.

We have a standard deal - we'll invest $120k in return for 7% of the company's equity. While we may deviate from this in exceptional cases, it will still be the case for almost all of the companies we fund.

Sam Altman, Y Combinator

3) The Scorecard Method

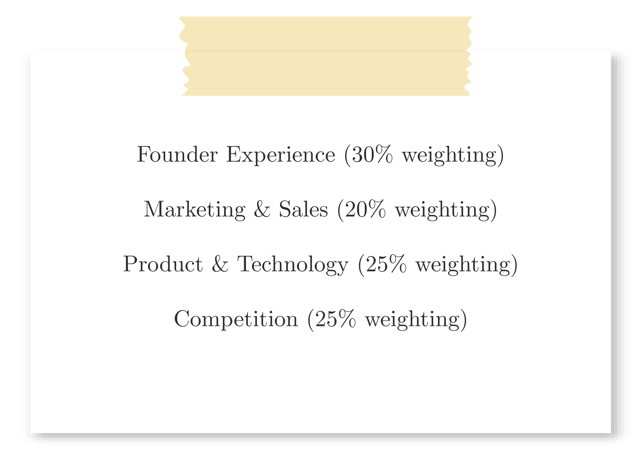

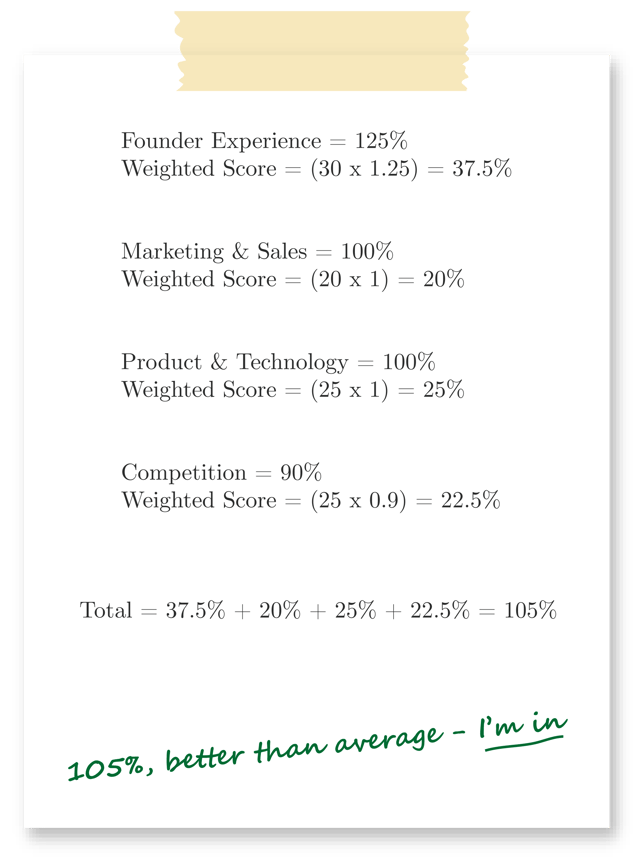

The Scorecard method is a variation on the comparison method detailed above. It's commonly used by angel investors to compare a new investment opportunity to an "average" startup in a given region and industry,

Let's assume that a typical early-stage B2B SaaS startup, in London, is valued at $1.5 million. An angel would create a list of desirable characteristics, outlining the factors they believes impactstartup success (things like founder experience, sales & marketing expertise and industry competition).

These factors are then subjectively weighted according to their perceived impact on success.

The investment opportunity is then scored across each of these categories, with its score determined by its superiority or inferiority compared to an "average" startup.

If a particular criterion is determined to be average, it scores 100%; better than average and it'll score over 100%; worse than average, less than 100%. These scores are then added together for a final scorecard valuation.

Returning to our average valuation of $1.5 million, we can see that this particular investor believes the new startup to be more valuable than the average (by 5%), and worth $1.575 million (1.5 * 1.05) as a result.

4) The Venture Capital Method

Whenever investment is offered in exchange for equity, the investor needs an exit to recoup their money (and hopefully profit).

Both angels and VCs will have a particular return they need their portfolio companies to generate, and the Venture Capital method allows investors to work backwards from their intended return, and calculate the value and equity requirements of a particular deal.

Imagine an investor that's looking to invest in your startup, with the intention of an exit in three years.

Three years from now, you're forecasting that your company's post-tax earnings will be $2 million. In order to work out how much your company could feasibly be sold for (its terminal valuation), we need to multiply those post-tax earnings by the company's revenue multiple (we'll explore this later). For this example, we're using a multiple of 15:

$$\text{Terminal Value}=\text{Forecasted Revenue}\times\text{Revenue Multiple}$$

$$\text{Terminal Value}=2\text{ million}\times15=30\text{ million}$$

Most investors have an expected return (their Internal Rate of Return, or IRR) they need their portfolio companies to generate: in this instance, let's assume the startup needs to grow by 30%, year-on-year.

Assuming an initial investment of $150,000, the investor needs an exit value (the amount their shares will be worth upon sale) of roughly $330,000:

$$150000\times(1.3^{3})=329550$$

We can then work out the percentage of the company the investor would need to own to generate that return when the company is finally sold (at its terminal value of $30 million):

$$\frac{329950}{30000000}=10.985%$$

To sell their equity for the required amount, the investor needs to own almost 11% of the company.

However, subsequent rounds of investment will serve to dilute their ownership, so to finish on 11%, they'll need their starting share to be higher. With an expected dilution of 25% (a common figure for VC investments), we can work out what their starting equity stake would need to be: in this instance, closer to 15%.

$$\frac{10.985%}{(1-0.25)}=14.646%$$

Lastly, we can use these figures to work out the company's current valuation. Assuming the investment of $150,000 is worth 14.6% of the company, the startup's post-money valuation is just over a million dollars...

$$\frac{150000}{0.14646}=1024170$$

...and its pre-money valuation is about $870,000:

$$1024170-150000=874170$$

5) Discounted Cash Flow

The Discounted Cashflow Method values a startup by predicting its future cashflow, and then discounting it to reflect:

- A. the time value of money (typically the risk-free interest the investment could yield over the same time period)

- B. the risk of that cashflow failing to materialise.

In order to predict future cashflow with any degree of certainty, it's necessary to have a stable history of revenue: something which most startups lack. As a result, this type of valuation (and many of the other late-stage valuation methods that follow) is used in conjunction with other methodologies as a starting point for valuation.

...whilst the methodology might be theoretically more rigorous than the simpler working back from projected exit values using a target multiple return, the input variables are sufficiently uncertain that the extra complexity doesn’t bring you any extra accuracy.

Nic Brisbourne, The Equity Kicker

6) Revenue Multiples

Revenue multiples are another form of comparative valuation, using data from public companies to draw comparisons to earlier-stage startups.

Investors begin valuation by looking at public companies similar (in terms of industry vertical, revenue growth rate, etc.) to their target startup. As these comparison companies are publicly traded, it's possible to find out two important pieces of information:

- The company's Enterprise Value, an approximation of the cost of buying it.

- The company's earnings.

It's relatively simple to work out a target startup's earnings, but it's much harder to calculate its potential sales value. Instead, we can look to comparable businesses to find the relationship between their earnings and their valuation, and extrapolate that relationship to our own startup.

Their are several ways of doing this, each with their own pros and cons:

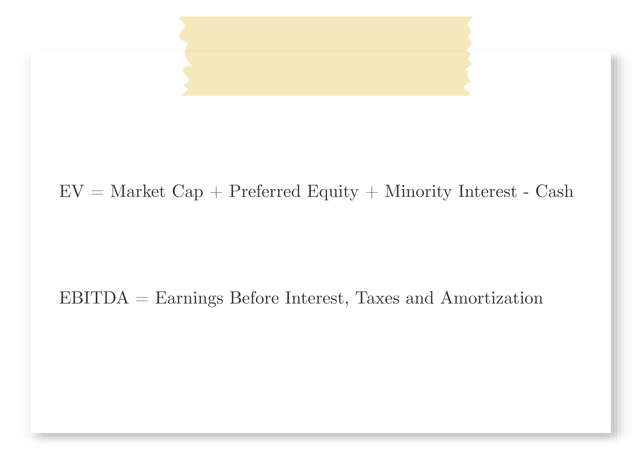

We'll stick to one of the most common methods: Enterprise Value (EV) to EBITDA.

For example, let's assume a public company has an Enterprise Value of $220 million, and an EBITDA of $44 million:

$$\text{EV }=200\text{m Market Cap}+60\text{m Liabilities}-40\text{m Cash}=220\text{m}$$

$$\text{EBITDA }=44\text{m}$$

Applying the formula, the company has an EV/EBITDA ratio of 5:

$$\frac{\text{EV}}{\text{EBITDA}}=\frac{220\text{m}}{44\text{m}}=5$$

In simple terms, this means the company is valued at 5x its earnings. By calculating this ratio across a broad range of similar companies, we can calculate the median revenue multiple for businesses of this type, and use that to value our own startup:

$$\text{Estimated Value}=\text{Startup Revenue}\times\text{Median EV/EBITDA Multiple}$$

Changes to the median revenue multiple for startup companies reflect changing market trends and levels of investor confidence.

From a relatively stable market of 5x revenue between 2004 and 2011, the valuation of SaaS startups exploded to an all-time high of between 12x and 20x revenue in 2013. Since then, multiples have settled back down, but despite talk of a "bubble", SaaS startups are still worth significantly more than they were a decade ago.

In 2011, only a few companies traded at greater than 10x, even though one business was growing at more than 150% annually. 2012 was more of the same.

2013 on the other hand saw some astronomical multiples. 35x, 28x, 19x, 18x. 2014 recorded a 45x multiple. And since then, valuations have contracted with every single public business trading under 10x.

Tomasz Tunguz, Redpoint

Recommended Reading

Risks of SaaS Startup Funding

From signalling risk to the startup graveyard, fundraising is a perilous path for startup founders to walk. But with high risk comes high reward.

Securing investment can provide the resources you need to scale, and many of the biggest pitfalls faced by founders are well understood. With a bit of preparation prior to seeking investment, these can even be side-stepped.

The predominant cause of big failures versus small failures is too much funding... What funding does is cover up all the problems that a company has. It covers up all the mistakes, it enables the company and management to focus on things that aren't important to the company's success and ignore the things that are important.

Shikhar Ghosh, Harvard Business School

1) Signalling Risk

Being a seed investor grants privileged access to a startup's inner workings. So, when the time comes to raise a Series A, if your investor chooses to lead the round, that sends a powerful signal to the market: something good is happening behind the scenes of Startup X, and it'd be a smart move to get involved.

But what happens if your investor doesn't follow on?

Regardless of their specific motivations, the market gets the same message: the people with the best insight into Startup X's performance haven't lead their Series A, so we need to stay away. If they won't put their capital at risk, why should we?

The average VC-backed seed company raises a Series A 35% of the time, or 51% of the time if it's a smart money VC (a VC that provides strategic guidance, and not just capital). But if that smart money VC doesn't follow-on, the chances of raising a Series A round plummet to 27%. This is the signalling risk of VC seed funding.

This investor signalling has a huge effect on venture financing dynamics. If Sequoia wants to invest, so will every other investor. If Sequoia gave you seed money before but now doesn’t want to follow on, you’re probably dead.

Chris Dixon, Andreessen Horowitz

2) Becoming an "Option"

If we look at the biggest macro-trends in startup funding, it quickly becomes apparent that:

- More startups are founded each year.

- Investors are willing to invest more than ever before.

This is creating a real problem for investment-hungry startups: VCs are increasingly happy to make small, speculative investments on the off-chance they'll succeed, allowing the VC to lead a much more lucrative Series A.

These speculative investments bring with them two kinds of risk: signalling risk if the VC then declines your Series A, and the opportunity cost of taking capital from someone unwilling to advise your startup, instead of an investor who would be more hands-on.

...you need to be careful with funds that have done 20–30 seeds deals in fairly rapid succession. Talk to companies that have taken this money and see if they’ve gotten support.

I have spoken at length to one such entrepreneur who tells me that he hardly hears from his VC. He was told informally that they view him as an “option” whereby they can wait and see if another VC makes an offer. If a VC term sheet comes in they begin their due diligence process. I recommend you do your own due diligence before deciding whether to take this money..

Mark Suster, Upfront Ventures

3) Loss of Control

Capital comes at a cost: equity. Even if you start out looking for modest amounts of capital, many startups find that the more investment they raise, the more future investment they need, as their burn rate increases and their swelling panel of investors demand ever-faster growth.

This makes it extremely likely that come the latter stages of fundraising, you, the startup founder, will no longer be the majority shareholder of your business. Even if you're happy sacrificing your majority stakehold for the good of the company, the loss of board control can leave you powerless to veto the issuing of further shares, diluting your stake even further.

- At their time of IPO, Box CEO Aaron Levie owned just 5.7% of the company he founded.

- After losing control over the company, Sandy Lerner, co-founder of Cisco, was fired by one of the company's early investors.

- When Groupon reported a larger-than-expected quarterly loss, founder Andrew Mason found himself out of a job, issuing a memo that read: "After 4 1/2 intense and wonderful years as CEO of Groupon, I’ve decided that I’d like to spend more time with my family. Just kidding – I was fired today."

I did not understand an investor could be an adversary. My family had a small business. I always thought that if someone invested in your business, that meant he or she believed in it. I assumed our investor supported us, because his money was tied up in our success.

I did not realize he had decoupled the success of the company from that of the founders.

Sandy Lerner

4) The Startup Graveyard

Investors (particularly VCs and financial institutions) will perform rigorous due diligence, and scrutinise every aspect of your business model prior to investing. Securing investment could even be considered a vote of confidence, suggesting that your business is in good shape. But, crucially, investors are fallible, and investment doesn't always increase your chances of success.

Only 41% of Y Combinator's portfolio companies are still funded and in operation - greater than the 90% failure rate predicted for startups as a whole, but far from ideal.

If we stretch our definition of success even further, and look at only those companies that have gone on to exit, that success rate drops down to 13% (and just 4% for 500 Startups). VCs will be more discerning with their investments, but high failure rates are still part-and-parcel of their portfolio.

Typical portfolio company failure rates across the industry defined as either shutdowns or returning capital are roughly 40%-50%.

Tomasz Tunguz, Redpoint

5) The Forced Exit

But what happens if you don't fail?

VCs, angels and almost every other type of equity investor need an exit to make money from their investment: an opportunity to cash-in their shares at a profit.

VC funds also have a shelf-life: most are designed to offer returns over a ten year period. As that deadline looms, your investor needs to steer your company towards an exit. This is fine for long-time founders that set-out to scale and sell their company. But what if you don't want to go public or sell your company? And what if you joined the VC fund towards the end of their ten year cycle? Even though you don't want to sell or IPO, your investors will.

When combined with the loss of control almost all founders experience, that can mean full steam ahead for an exit, even if you'd rather stay the course.

Recommended Reading

SaaS Fundraising Best Practices

Starting a business is inherently risky, and, there are serious risks associated with raising investment. However, you're an entrepreneur - the type of person that starts a business when 90% are destined to fail. Armed with a suitable warning, you'll be able to side-step the risks we've covered, and make funding work for you.

But risks aside, there are good ways to raise funding, and there are great ways. To get the most out of every funding round, it's important to approach your investors with a game plan, to pre-empt their expectations and raise investment in the best way possible.

I would advise entrepreneurs to reverse engineer the end state. As a rough rule of thumb, each funding milestone should last two years. One full year to put heads down on building the business and then pick up your heads to fundraise with the intent of closing six months after. That way, you’re never within six months of being out of cash.

Eric Feng, Kleiner Perkins

1) Raise Before You Need It

It's easy to get capital when you don't need it; when growth is ramping up and revenue is turning from a trickle into a torrent. But leave it too late, and try to raise capital when you're relying on it for continued growth, and you'll have a much harder time convincing investors.

2) Don't Leave It Too Late

Securing investment is usually a long, slow process. A study by DocSend and Harvard Business School found that startups need an average of 40 investor meetings to close a funding round. Seed rounds take an average of nearly 13 weeks to complete, and given the increasing levels of scrutiny and due diligence expected as you raise further funding, expect those timescales to increase through Series A and beyond.

3) Don't Get Greedy

Investment should never be a goal in its own right. If that sounds trite, it shouldn't: early company valuations are largely driven by the amount you raise, so the more money you secure, the more valuable your company appears.

But investment is designed to be spent. No matter how much money you raise, you'll likely spend it at the same rate - and not always in the smartest way. As Mark Suster argues, over-funding can even stifle creativity, allowing founders to spend their way out of a problem instead of thinking their way clear.

Over-raising also makes it harder to raise subsequent rounds. Any investor wants to see the value of your company increase between rounds, but if you've inflated your valuation from the get-go, you've made it much harder to justify your next stratospheric valuation, and the next.

...having limited resources forces you to make hard choices about what you’re build and what you won’t. It forces harder decisions about whom you’ll hire and whom you’ll delay. It forces you to negotiate harder on your office lease and take more frugal space. It forces you to keep salaries reasonable in a market where wage inflation has been the norm for years.

Mark Suster, Upfront Ventures

4) Pre-Empt Due Diligence

Due diligence is a necessary evil of the startup funding process, but that doesn't mean you should bury your head and passively endure it. Most investors will seek out similar types of information, so you can ease the process by preparing data in several core fields:

- Key performance metrics

- Financial plan

- Customer acquisition channels

- Current sales pipeline

5) Vet Your Investors...

It's hard to find great investors: in DocSend's study, their participants reached out to an average of 20-30 good-fit investors before closing their round. But the laborious process of finding investors doesn't mean you should settle for just anyone.

Your investors will be involved in your business for the long-haul. Their ideas and willingness to contribute will shape the direction of your startup in ways you can't even imagine - and as your company grows, their support grows more and more important. With each additional round, you increase the number of people vying for control, so the more investors you have aligned with your vision, the better.

Unless you’re one of a very small handful of companies, the heady days of meeting with four firms and then closing a deal are long gone. You need to start broad, make a long list and take a lot of meetings to find the right partner.

I use that term precisely - you should pick the partner, not the firm. You’re getting into a 7–10 year relationship with that partner, so you better feel really good about him/her and be very clear on how they will add value.

Mehul Patel, Hired

6) ...And Their Fund

Ethos and attitude aside, it's also essential to dig into the mechanics of any investor's fund. Different types of fund require different sizes of exit to generate a suitable return, and their needs will have a direct impact on the direction they encourage your business to go. If you work with a smaller fund, a more "modest" exit will be acceptable, but partnering with the biggest funds can seriously up the pressure to hit vaunted unicorn status.

Let’s take a look at the economics of two hypothetical funds, a $50M and a $500M fund. Assuming each fund seeks to return three times the capital invested in 10 years to provide a good return for investors, the total value of the portfolios must be $150M and $1,500M respectively. The funds have different target ownerships and therefore different average investment sizes.

All this boils down to a target value of a company at exit. The larger the fund, the larger the exits must be for the venture investors to be successful.

Tomasz Tunguz, Redpoint

7) Don't Assume It's a Done Deal

Finally, even if you survive the meetings, pitches, scepticism, scrutiny and final due diligence, don't assume that the deal is done. When Christoph Janz surveyed 110 founders, a significant percentage had experienced VCs backing-out at the final stages of the fundraising process.

By the time you sign a term sheet, you should have made up your mind and should be done with your “commercial due diligence”.

Christoph Janz, Point Nine Capital

Apparently that’s not the case. 14 people, a shocking 14% of the respondents, said they’ve already experienced an investor backing out after a term sheet has been signed. Unless these 14 founders had skeletons in their closets, that’s 14 too many. As one founder said in the comments, if this happens it can kill a company.

Recommended Reading

Closing Thoughts

Building a SaaS startup is hard. The vast majority of newly-founded businesses fail; and those that last long enough to raise funding have an incredibly slim chance of hitting unicorn status.

But somewhere between those billion dollar outliers, and the crowded startup graveyard, lies a place of tangible, achievable success. Every year, thousands of startup founders succeed in turning their vision into reality, creating companies that change their lives, and the lives of thousands of people around them.

These are the founders that avoid the pitfalls of fledgling startups:

- running out of cash.

- hiring the wrong people.

- neglecting sales and marketing.

- being out-competed.

Crucially though, startup fundraising isn't a panacea, and it isn't a prerequisite to success - it's a tool. And in a competition between skilled, committed founders, sometimes the difference between success and failure comes down to the tools they each have at their disposal.